Identifying Undue Influence Over a Will-Maker

As we age or become ill, we are especially vulnerable to manipulation from those who seek to defraud or steal. Targeted attacks on susceptible older people to exert what attorneys regard as “undue influence” constitutes elder abuse. It disrupts the older persons’ impulse to provide for loved ones and instead leaves assets to the manipulator. Often, family members do not find out about a change in estate plan until after their loved one has died. Most often, a manipulator will seek to keep last-minute changes of inheritance quiet.

If you believe undue influence was at play regarding the will of your deceased love one, you can take your suspicions to probate court. Proving undue influence can prompt the probate judge to rule that the will and other estate planning documents are invalid. Contesting undue influence is allowable even if there is no regular probate court proceeding to probate the will and distribute estate assets.

A probate judge will look for a claimant to prove that the will either

- Leaves property in an unexpected manner, cutting out close family members in favor of others without an obvious explanation before their death

- The will-maker may have been particularly trusting of, or dependent on, the influencer, sometimes referred to as a confidential relationship

- Frailty, illness, or fear of abandonment make the will-maker susceptible to undue influence

- The confidential relationship influencer took outright advantage of the will-maker and directly benefited by substituting a will of their choosing and not the will-makers.

Undue influence is not the same as meddling or offering unsolicited advice or opinions to an aging family member. As long as a will-maker is mentally and physically independent, they can follow or disregard opinion and advice as they choose. The situation changes when physical frailty or cognitive decline can leave a will-maker susceptible to undue influence. As an example, out of need, an older person might welcome a cousin into their home to provide them care. That older person’s children may have suspicions about the cousin’s motivation or begin to experience estrangement from their loved parent. In this event, direct conversations with the will-maker and their permission to confirm through their attorney that the will and estate documents have not changed may be necessary.

Proving undue influence in probate court will require testimony from people who knew the will-maker well, such as medical doctors and health care providers, caregivers, lawyers, and other advisers, as well as family members. These individuals then testify about what they know regarding the relationship between the deceased individual and the person being accused of exerting undue influence.

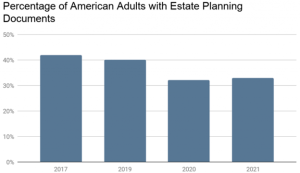

Because probate courts try to adhere to the last “voice” of the decedent, the best and least expensive way to prevent undue influence is to have an open discussion with your loved one or aging parent. Discuss their estate planning and its impact on all generations in the family well in advance of them becoming vulnerable. According to a survey by Caring.com, only 45 percent of adult children discuss what their parents’ plans are for when they need care. And only 30 percent discuss who will pay for and manage their care. Even during the COVID-19 pandemic, only a small percentage of Americans have the proper estate planning documentation. Acting now to prevent potential abuse is vastly preferable to introducing allegations of undue influence in probate court.

If your loved one is already having difficulty making rational decisions, including estate planning options, for their well-being, seek a guardianship or conservatorship through the courts. Appointing a trusted person will ensure the respect of a loved one’s wishes and prevent undue influence. If they are capable, review existing estate plans and share feelings openly. If no plan exists, encourage your parents to contact an elder law attorney and discuss the need for a will, trust, or both. Understanding and helping loved ones with aging preparations should be a family priority, and open discussion can prevent undue influence.

If you believe a loved one may have been the victim of undue influence (or is currently being influenced) please give us a call. We would be happy to discuss your situation confidentially. Please contact our Wichita office at 316-830-5603.